CT JD-CV-3a 2015-2024 free printable template

Show details

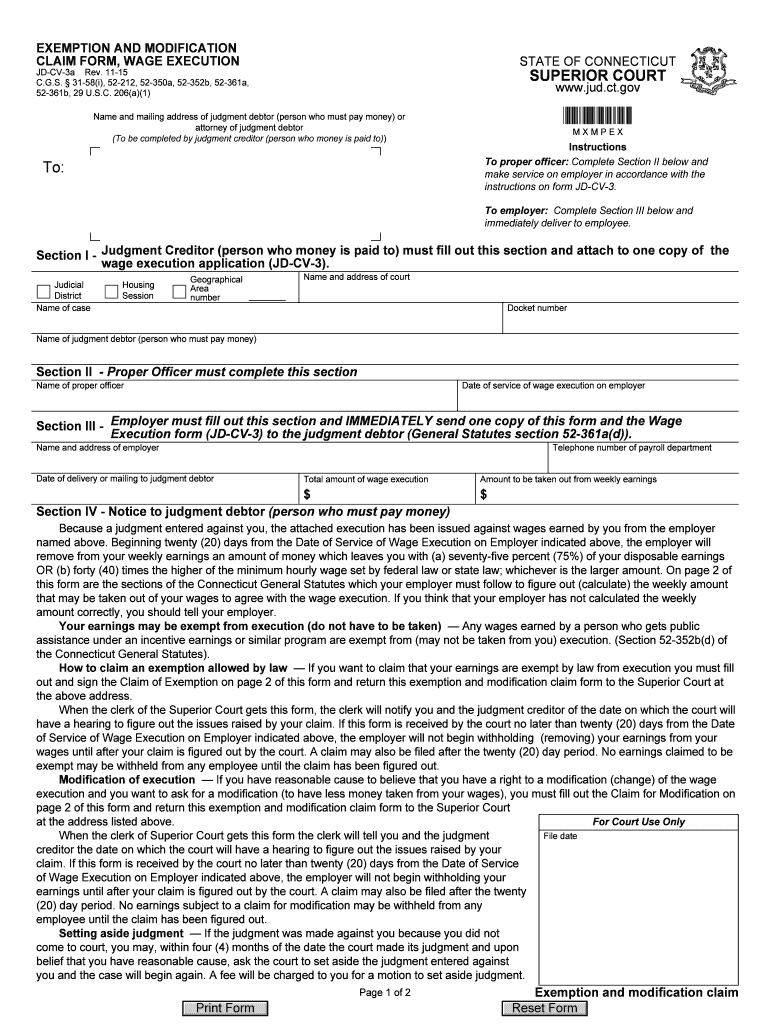

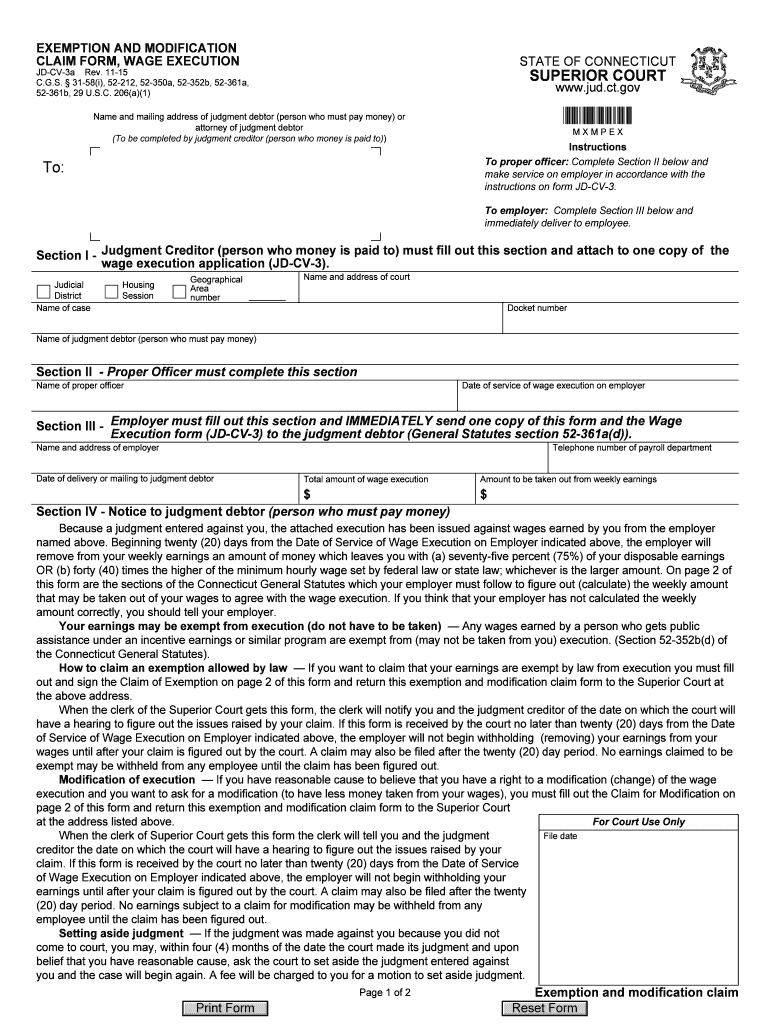

EXEMPTION AND MODIFICATION CLAIM FORM WAGE EXECUTION STATE OF CONNECTICUT SUPERIOR COURT JD-CV-3a Rev. 11-15 C. G*S* 31-58 i 52-212 52-350a 52-352b 52-361a 52-361b 29 U*S*C. 206 a 1 www. jud. ct. gov Name and mailing address of judgment debtor person who must pay money or attorney of judgment debtor To be completed by judgment creditor person who money is paid to To MXMPEX Instructions To proper officer Complete Section II below and make service on employer in accordance with the To employer...

pdfFiller is not affiliated with any government organization

Get, Create, Make and Sign

Edit your connecticut exemption claim form form online

Type text, complete fillable fields, insert images, highlight or blackout data for discretion, add comments, and more.

Add your legally-binding signature

Draw or type your signature, upload a signature image, or capture it with your digital camera.

Share your form instantly

Email, fax, or share your connecticut exemption claim form form via URL. You can also download, print, or export forms to your preferred cloud storage service.

Editing connecticut exemption claim form online

To use the professional PDF editor, follow these steps:

1

Log in to account. Start Free Trial and sign up a profile if you don't have one.

2

Prepare a file. Use the Add New button. Then upload your file to the system from your device, importing it from internal mail, the cloud, or by adding its URL.

3

Edit connecticut exemption form. Rearrange and rotate pages, add and edit text, and use additional tools. To save changes and return to your Dashboard, click Done. The Documents tab allows you to merge, divide, lock, or unlock files.

4

Get your file. Select the name of your file in the docs list and choose your preferred exporting method. You can download it as a PDF, save it in another format, send it by email, or transfer it to the cloud.

With pdfFiller, it's always easy to deal with documents.

CT JD-CV-3a Form Versions

Version

Form Popularity

Fillable & printabley

How to fill out connecticut exemption claim form

How to fill out connecticut exemption claim form:

01

Obtain the form: The connecticut exemption claim form can be obtained from the Connecticut Department of Revenue Services website or by visiting a local tax office.

02

Provide personal information: Fill out the required personal information section, including your name, address, social security number, and contact information.

03

Determine exemptions: Review the instructions accompanying the form to determine if you qualify for any exemptions. Common exemptions may include dependent exemptions, disability exemptions, or senior citizen exemptions.

04

Calculate exemptions: If you qualify for exemptions, calculate the amount you are eligible to claim. This can usually be done by following the instructions provided with the form or by using a tax calculator.

05

Complete the form: Fill out the remaining sections of the form, including income information and deductions, if applicable.

06

Attach supporting documents: Depending on the exemptions you are claiming, you may be required to attach supporting documentation. This may include copies of birth certificates, disability certification, or income statements.

07

Review and sign the form: Carefully review all the information you have provided on the form and make any necessary corrections. Sign and date the form in the designated areas.

08

Submit the form: Once you have completed the form and attached any required documents, submit it to the appropriate address provided on the form or as instructed by the Department of Revenue Services.

09

Keep a copy: Make a copy of the completed form and supporting documents for your records.

Who needs connecticut exemption claim form:

01

Individuals who qualify for specific exemptions: The connecticut exemption claim form is necessary for individuals who qualify for certain exemptions under Connecticut state tax laws. These exemptions can help reduce the amount of state taxes owed or increase the potential for a tax refund.

02

Taxpayers seeking to lower their tax liability: The form is used by taxpayers who are looking to lower their overall tax liability by claiming eligible exemptions.

03

Individuals with dependents or specific circumstances: The form is particularly relevant for individuals with dependents, such as children or elderly relatives, who may qualify for dependent exemptions. Additionally, individuals with disabilities or certain medical conditions may also be eligible for specific exemptions outlined in the form.

Video instructions and help with filling out and completing connecticut exemption claim form

Instructions and Help about connecticut exemption form pdf

Fill connecticut modification form : Try Risk Free

People Also Ask about connecticut exemption claim form

How do I object to wage garnishment in Louisiana?

Can a debt collector garnish your wages in CT?

How to file a claim of exemption wage garnishment in Louisiana?

What are the exemptions for garnishment in Louisiana?

How do I stop a wage garnishment in CT?

How do I stop a wage garnishment in Ohio?

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

What is connecticut exemption claim form?

Connecticut Exemption Claim Form (Form CT-941) is a form used by employers in the state of Connecticut to report the amount of wages paid to an employee who is exempt from Connecticut income tax withholding. The form is available on the Connecticut Department of Revenue Services website.

Who is required to file connecticut exemption claim form?

The Connecticut Exemption Claim Form is required to be filed by any individual or business claiming a sales and use tax exemption.

What is the purpose of connecticut exemption claim form?

The Connecticut Exemption Claim Form is used to claim personal property tax exemptions for eligible individuals and organizations. The form is used to document the exemption and provide proof to the municipality that the individual or organization is eligible for the exemption.

When is the deadline to file connecticut exemption claim form in 2023?

The deadline to file a Connecticut Exemption Claim Form in 2023 has not yet been determined. The Connecticut Department of Revenue Services typically releases the filing dates for the upcoming year in November or December of the previous year.

What is the penalty for the late filing of connecticut exemption claim form?

The penalty for late filing of a Connecticut Exemption Claim Form is not specified. However, if you fail to file the form as required, you may be subject to a fine or other penalties imposed by the state.

How to fill out connecticut exemption claim form?

To fill out a Connecticut exemption claim form, follow these steps:

1. Obtain the form: Download the Connecticut exemption claim form from the official website of the Connecticut Department of Revenue Services (DRS) or request a hard copy by contacting the DRS directly.

2. Provide personal information: Fill in your personal information, such as your full name, address, Social Security number, and contact details. Additionally, provide any relevant identifying numbers, such as your Connecticut Tax Registration Number or Federal Employer Identification Number (FEIN), if applicable.

3. Choose the exemption type: Indicate the reason for claiming exemption on the form, such as being a nonprofit organization, religious institution, or qualifying entity as defined by Connecticut tax laws. Select the exemption that applies to your situation.

4. Provide supporting documentation: Attach any required supporting documentation to substantiate your exemption claim. This may include a copy of your 501(c)(3) determination letter from the IRS if claiming exemption as a nonprofit, or any other relevant proof based on the chosen exemption type.

5. Provide exemption period: Specify the period for which you are claiming exemption. This may be for a specific tax year or a continuous period, depending on the circumstances.

6. Sign and date: Sign and date the form to certify that the provided information is accurate and complete.

7. Submission: After completing the form, submit it to the address indicated on the form. Ensure that you retain a copy for your records. If you have any questions or need guidance, reach out to the DRS through their helpline or website.

Note: It is always advisable to consult with a tax professional or tax advisor when completing any tax-related forms to ensure compliance with applicable state laws and regulations.

What information must be reported on connecticut exemption claim form?

The information that must be reported on the Connecticut exemption claim form includes:

1. Personal Information: This includes your name, address, social security number or individual taxpayer identification number, and date of birth.

2. Filing Status: Indicate your filing status, such as single, married filing jointly, married filing separately, etc.

3. Exemption Code: Provide the exemption code that applies to your situation. These codes represent various exemptions, such as personal exemptions, dependent exemptions, and other specific exemptions.

4. Dependents: If applicable, provide information about your dependents, including their names, social security numbers or individual taxpayer identification numbers, and relationship to you.

5. Income Information: Report your income details, such as wages, salaries, tips, taxable interest, dividends, pensions, and any other sources of income.

6. Deductions: List any deductions you are claiming, such as student loan interest deduction, self-employment tax deduction, or other allowable deductions.

7. Credits: Report any tax credits you are eligible for, such as child tax credit, earned income credit, education credits, or any other applicable credits.

8. Signature: Sign and date the form to certify that the information provided is true and accurate.

Note: It is important to refer to the specific instructions provided on the Connecticut exemption claim form for complete and accurate reporting requirements.

How can I get connecticut exemption claim form?

It’s easy with pdfFiller, a comprehensive online solution for professional document management. Access our extensive library of online forms (over 25M fillable forms are available) and locate the connecticut exemption form in a matter of seconds. Open it right away and start customizing it using advanced editing features.

Can I sign the ct exemption claim form electronically in Chrome?

Yes, you can. With pdfFiller, you not only get a feature-rich PDF editor and fillable form builder but a powerful e-signature solution that you can add directly to your Chrome browser. Using our extension, you can create your legally-binding eSignature by typing, drawing, or capturing a photo of your signature using your webcam. Choose whichever method you prefer and eSign your connecticut claim form in minutes.

How do I complete exemption claim on an Android device?

Use the pdfFiller Android app to finish your ct modification form and other documents on your Android phone. The app has all the features you need to manage your documents, like editing content, eSigning, annotating, sharing files, and more. At any time, as long as there is an internet connection.

Fill out your connecticut exemption claim form online with pdfFiller!

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.

Ct Exemption Claim Form is not the form you're looking for?Search for another form here.

Keywords relevant to ct claim form

Related to ct modification form

If you believe that this page should be taken down, please follow our DMCA take down process

here

.